As referências vão das mais antigas para as mais recentes. É mais do mesmo, mas de interessante têm alguns comentários "não politicamente correctos" sobre as elites portugueses; alguns gráficos conhecidos que importa não esquecer; outros, novos, curiosos, que eu gostaria de ver reproduzidos para Portugal e alguma história económica. Merecem ser acedidos e lidos na totalidade.

The Portuguese Economy: Blessing in disguise? The key question now for me is whether the painful debt-reducing cuts that will follow will also be complemented by a number of reforms that allow the country to grow its way out of debt, in a sustainable manner. This will require strong moves towards more flexible markets and more efficient institutions that the ruling, protected intelligentsia have always decried.

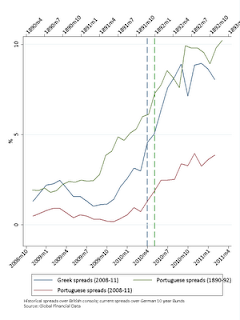

"There is a also striking similarity between the levels of historical Portuguese spreads up to and after the January 1892 default (green dashed line) and the Greek bailout (blue dashed)"

The Irish Economy » Blog Archive » Portuguese Bailout Request, ECB Rate Hike: "[....] Portugal has huge issue with Education/skills [have info, will find later], and an entrenched upper-echelon that regulatory captures almost all and probably closer to the Egyptian upper echelon under Mubarak; [....]"

wp_664.pdf (application/pdf Object) The creation of the Economic and Monetary Union (EMU) has not brought significant gains to the Portuguese economy in terms of real convergence with wealthier eurozone countries. We analyze the causes of the underperformance of the Portuguese economy in the last decade, discuss its growth prospects within the EMU, and make two proposals for urgent institutional reform of the EMU. We argue that, under the prevailing institutional framework, Portugal faces a long period of stagnation, high unemployment, and painful structural reform, and conclude that, in the absence of institutional reform of the EMU, getting out of the eurozone represents a serious political option for Portugal.

The Portuguese Economy: The Future of the Past: "History does not repeat itself, but in Portugal it certainly rhymes. It's easy to say now that the request for foreign aid made yesterday by the Prime Minister was the inevitable outcome of the accumulated stress of the last two years. But during that time the government, the European Commission and even the IMF sought to persuade us that the Portuguese case was different from the Greek and then the Irish. There might be merit in this differentiation, but sometimes it's useful to compare the present with our own past, even if distant. A quarter century of European integration and ten years of Euro membership were enough to convince us that Portugal had 'graduated' in the class of nations, leaving behind a past of financial and currency instability. The dreaded return of the IMF (or EFSF, as the president insists) re-evokes the memories of 1978 and 1984, but in my opinion the past that best rhymes with the present is the late nineteenth century. I speak, of course, of the crisis of 1890-92, which culminated in the last Portuguese bankruptcy. The parallels are striking and instructive."

BBC - Newsnight: Paul Mason: Trichet: welcome to my great big fat Euro fiasco: "t's Vorsprung Durch Technik versus 'manyana', cold efficiency versus laid-back Mediterranean sloth, it's the Europe of no motorcyle helmets versus the Europe of precise train timetables. It is every cultural stereotype you've ever heard about the two kinds of people who inhabit this continent.And for now, economically, it's valid: there are two Europes and they are diverging.It's no longer a two speed Europe: it's a two tier Europe with the bottom half spiralling into low growth, penury and social crisis - and the top tier is booming. German industrial output, up 15% year on year today, stands in contrast to a slump in Ireland, Greece and now - once the austerity kicks in for real - Portugal.Portugal last night joined the club of countries needing a bailout. It'll probably take E80bn to sort out - but that's not the problem. The problem is the conditions attached will be further austerity: the very austerity the Portugese parliament rejected; and - from an objective standpoint more important - which will make it difficult for Portugal ever to grow its way out of crisis."

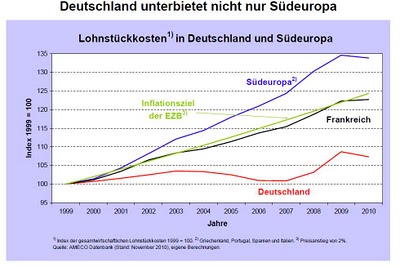

"During the eurobubble years, there were huge capital flows to peripheral economies, leading to a sharp rise in their costs relative to Germany. Now the bubble has burst, and one way or another those relative costs need to be brought back in line. But should that take place via German inflation or Spanish deflation? From a pan-European view, the answer is surely some of both — and given that deflation is always and everywhere very costly, the bulk of the adjustment should in fact take the form of rising wages in Germany rather than falling wages in Spain."

Europe's debt crisis: Under pressure | The Economist: "Portugal now joins Greece and Ireland in the euro zone’s intensive-care ward. Its public debts are nowhere near as monumental as Greece’s; its banks not as reckless as Ireland’s. It has succumbed because of a humdrum failure to rein in wage increases and to modernise a bureaucracy schooled in tallying the quiet remains of the first global empire, as well as an inability to coax upstanding family companies, which for centuries have crafted textiles, ceramics and shoes, into competing with the Chinese. As a result, harsh as it may seem, a country whose collective memory is still scarred by the austerity demanded by the IMF in the early 1980s must once again subject itself to tough reforms demanded by foreigners."

"There’s clearly a fair amount of sunshine in the chart for Germany, although it’s very hard to be optimistic about the UK. But will anyone present anything like this chart for the Portuguese economy?"

Sorry that it’s in German — but it shows unit labor costs, with 1999=100. The red line is Germany; the black line is France; the green line is the ECB’s 2 percent inflation target; the blue line is southern Europe. The point is that the introduction of the euro led to a period of low interest rates in southern Europe, triggering an inflationary boom; when the boom ended, they were left uncompetitive with northern Europe. And the ECB is in effect demanding that all the removal of that competitiveness gap take place via deflation in the south, none of it through inflation in Germany."

Sem comentários:

Enviar um comentário