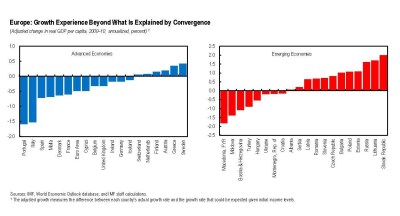

As the crisis in Europe deepens, it is worth asking how it all went wrong in the first place. In the past decade there have been stark differences in per capita GDP growth in Europe. Growth rates have ranged from close to zero in Italy and Portugal to more than 4 percent in the best performers. Why do some countries in Europe grow much faster than others? And how can those falling behind catch up before it is too late?

In part, these differences reflect “convergence”. It is much easier for poor countries to grow faster than it is for rich countries because they can import technology they do not already have. It is much more difficult to grow fast if you are already rich and at the technology frontier—now you can only get richer by innovation.

Integration into the global economy matters

What explains these differences? Both macroeconomic policies and barriers to growth.

Heavily regulated goods and labor markets and inadequate institutions and macroeconomic policies have kept some countries less flexible, less competitive, and less integrated into the global economy than their better-performing peers.

Indeed, it is striking that better performing countries are much more integrated in the world economy than are poor performers. Strong performers enjoyed high and increasing levels of trade, both in exports and in imports, while many of the poor performers have lower and stagnating levels.

In Austria, Germany, the Netherlands, and Sweden, the share of export and import in GDP rose by about 15 percent to more than 20 percent between 1995 and 2010. The same was true for the Czech and Slovak Republics, and, to a lesser extent, Poland. At the other end of the spectrum, the export-to-GDP and import-to-GDP ratios of Greece, Italy, Portugal, and Spain stagnated over those years.

How to recover from euro sclerosis

The problem of slow growing countries in Europe is not new. In the late 1970s and early 1980s, many countries in Europe suffered from “euro sclerosis”—high unemployment and low growth. These earlier periods provide important lessons, as they show that a change in policy can turn an economy around.

Let’s take the Netherlands and Sweden. In the 1980s and 1990s, these two countries undertook sweeping reforms to boost growth after a long period of poor performance. Their experience gives us pointers to reforms that could help other countries reverse their economic fortunes.

Both countries undertook reforms only after protracted economic malaise culminated in crisis. Income per capita was falling relative to that of Germany for about a decade; public finances were deteriorating, and fiscal deficits were growing. In the Netherlands, unemployment was rising because real wage costs were too high; in Sweden growth was held back by poor performing traditional industries, the banking crisis in the early 1990s, and stifling taxes.

Both countries addressed both macroeconomic imbalances and barriers to growth. Reforms focused on the most onerous bottlenecks. In the Netherlands, a main initial goal was to restore employment, which had been hurt by labor costs, and thus the centerpiece of the reform package was a wage agreement between employers and unions.

Other tax and benefit reforms also helped create jobs and encouraged more people to join the labor force. Sweden tackled its core problems on several fronts: fiscal consolidation, tax reform, clean up of the banking sector, and an overhaul of the wage bargaining system. Both countries also reduced regulation so new companies and industries could flourish.

Although reforms spanned more than a decade and took time to yield full benefits, they were very successful―per capita income in both the Netherlands and Sweden is now significantly higher than even that of Germany.

So what are the lessons for current poor performers?

- First, reforms work—but they take time. It takes time to do the reforms themselves. It takes times before their impact becomes visible—initially the economic situation may even get worse—and it takes time before the full impact is felt. But the benefits accumulate over time, and they can be significant.

- Second, addressing macroeconomic imbalances and removing barriers to growth are both essential. If deficits and debt are not brought under control, growth is unlikely to pick up. But correcting macroeconomic imbalances without also removing barriers to growth will hardly result in sustained high growth.

- Third, what should be reformed changes over time. As bottlenecks to growth disappear, new constraints become binding.

Sem comentários:

Enviar um comentário