|

| Or, notes on reading Martin Wolf |

agora, sobre as atribulações de um independente de esquerda nestes tempos da III República ...

28 de setembro de 2011

26 de setembro de 2011

O que é sinistro nisto não é só o conteúdo, mas também, o tom, o modo como é dito - isto é gente perigosa e devia ser policiada como é bom de ver

O bold é meu. Para ver as declarações do "trader" aceder à BBC News via endereço abaixo.

Ministers from the world's richest nations are reportedly on the way to agreeing a deal for troubled eurozone countries.Following the IMF meeting in Washington, the BBC understands that three elements have been discussed.They include a so-called "haircut" of Greece's sovereign debt, meaning institutions holding Greek debt would have to write off half of what they were owed. The plan also envisages an increase in the size of the European Union bailout fund to two trillion euros. European governments hope to have the plan in place in five to six weeks.

But one independent market trader - Alessio Rastani - told the BBC the plan "won't work" and that people should be trying to make money from a market crash.

____________________________

PS: Fui alertado para isto pelo Apocalypse: You, too, can profit from collapse | The Economist que diz o seguinte: "Between the remarkable take on the global economy in this video

and the interviewee's traderly insouciance, I'm not sure whether to

laugh or cry. Or grab a pitchfork. Or call him for investment advice.

You be the judge."

O sarilho em que estamos metidos explicado de modo exemplar e sucinto

Is it possible to be both terrified and bored? That’s how I feel about the negotiations now under way over how to respond to Europe’s economic crisis, and I suspect other observers share the sentiment.On one side, Europe’s situation is really, really scary: with countries that account for a third of the euro area’s economy now under speculative attack, the single currency’s very existence is being threatened — and a euro collapse could inflict vast damage on the world.On the other side, European policy makers seem set to deliver more of the same. They’ll probably find a way to provide more credit to countries in trouble, which may or may not stave off imminent disaster. But they don’t seem at all ready to acknowledge a crucial fact — namely, that without more expansionary fiscal and monetary policies in Europe’s stronger economies, all of their rescue attempts will fail.

25 de setembro de 2011

A verdadeira guerra de classes nos EUA

Conviria lerem todo o artigo.

Republicans and conservatives have done us a service by describing federal policies in terms of "class war." But by applying the term only to Obama's latest proposals to raise taxes on the rich, they have it all backward and upside down. The last 50 years have indeed seen continuous class warfare in and over federal economic policies.

24 de setembro de 2011

A Islândia é sempre uma surpresa e consegue dar a volta, neste caso, porque é pequena? Ou, dito de outra forma, qualquer outro país teria a latitude para o fazer? Cheira-me que não, mas importa reflectir, ou usar como "benchmark"....

Iceland Exits - NYTimes.com: Iceland is no longer under an IMF program; here’s the IMF report (pdf) pronouncing the adjustment program successful. Indeed. Iceland still has high unemployment and is a long way from a full recovery; but it’s no longer in crisis, it has regained access to international capital markets, and has done all that with its society intact.And it has done all that with very heterodox policies — debt repudiation, capital controls, and currency depreciation. It was as close as you can get to the polar opposite of the gold standard. And it has worked.

O limite da velocidade da luz é aborrecido: torna as viagens interestelares, se não impossíveis à escala da espécie humana, pouco práticas, limitadas e impraticáveis no âmbito da vida de alguém...

... Claro que a FC resolveu o problema especulando a existência de atalhos através de outras dimensões, do dito hiper-espaço. Ora senão que surge a notícia abaixo: talvez Einstein não tenha acertado nesta e haja, efectivamente, um qualquer atalho. Enfim, esperemos pela confirmação, que aliás está a ser pedida por todos, nomeadamente pelos cientistas implicados na descoberta do resultado, como exige a boa prática científica:

Breaking the Speed of Light: It’s been a tenet of the standard model of physics for over a century. The speed of light is a unwavering and unbreakable barrier, at least by any form of matter and energy we know of. Nothing in our Universe can travel faster than 299,792 km/s (186,282 mph), not even – as the term implies – light itself. It’s the universal constant, the “c” in Einstein’s E = mc2, a cosmic speed limit that can’t be broken.That is, until now.An international team of scientists at the Gran Sasso research facility outside of Rome announced today that they have clocked neutrinos traveling faster than the speed of light. The neutrinos, subatomic particles with very little mass, were contained within beams emitted from CERN 730 km (500 miles) away in Switzerland. Over a period of three years, 15,000 neutrino beams were fired from CERN at special detectors located deep underground at Gran Sasso. Where light would have made the trip in 2.4 thousandths of a second, the neutrinos made it in 60 nanoseconds – that’s 60 billionths of a second – a tiny difference to us but a huge difference to particle physicists!The implications of such a discovery are staggering, as it would effectively undermine Einstein’s theory of relativity and force a rewrite of the Standard Model of physics.

História dos nossos tempos e dos nossos erros, e muito possivelmente - o que será uma infelicidade - do nosso futuro

Leitura altamente recomendada - nomeadamente, por Krugman e pelo blogue Irish Economy. Deve ser lido na totalidade

[....] TODAY’S RECESSION does not merely resemble the Great Depression; it is, to a real extent, a recurrence of it. It has the same unique causes and the same initial trajectory. Both downturns were triggered by a financial crisis coming on top of, and then deepening, a slowdown in industrial production and employment that had begun earlier and that was caused in part by rapid technological innovation. The 1920s saw the spread of electrification in industry; the 1990s saw the triumph of computerization in manufacturing and services. The recessions in 1926 and 2001 were both followed by “jobless recoveries.”

In each case, the financial crisis generated an overhang of consumer and business debt that—along with growing unemployment and underemployment, and the failure of real wages to rise—reduced effective demand to the point where the economy, without extensive government intervention, spun into a downward spiral of joblessness. The accumulation of debt also undermined the use of monetary policy to revive the economy. Even zero-percent interest rates could not induce private investment.

Finally, in contrast to the usual post-World War II recession, our current downturn, like the Great Depression, is global in character. Financial disturbances—aggravated by an unstable international monetary system—have spread globally. During the typical recession, a country suffering a downturn might hope to revive itself by cutting its spending. That might temporarily increase unemployment, but it would also depress wages and prices, simultaneously cutting the demand for imports and making a country’s exports more competitive against those of its rivals. But, when the recession is global, you get what John Maynard Keynes called the “paradox of thrift” writ large: As all nations cut their spending and attempt to devalue their currencies (which makes their exports cheaper), global demand shrinks still more, and the recession deepens. [....]

23 de setembro de 2011

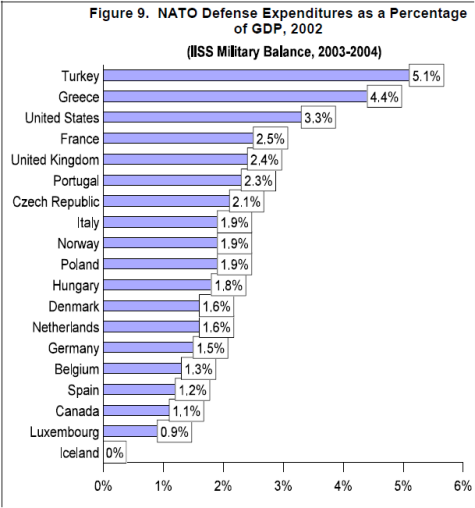

Peso da despesa com a defesa em Portugal versus outros países da NATO

Estava a rever algumas coisas e deparei-me com isto abaixo. Vem mesmo a calhar no quadro dos nossos problemas actuais. Gostaria de saber como o nosso nível com a despesa se decompõe para, nomeadamente, saber se a guerra colonial ainda justifica o peso relativo que aquela tem em Portugal face a muitos outros países da NATO.

Niall Ferguson: The 6 killer apps of prosperity | Video on TED.com

Over the past few centuries, Western cultures have been very good at creating general prosperity for themselves. Historian Niall Ferguson asks: Why the West, and less so the rest? He suggests half a dozen big ideas from Western culture -- call them the 6 killer apps -- that promote wealth, stability and innovation. And in this new century, he says, these apps are all shareable.

20 de setembro de 2011

Pequenas notas, despreocupadas e sem reservas, na antecipação do que dirá o PM

- Ferreira Machado disse aquilo que eu não conseguiria dizer de modo tão incisivo e curto: é preciso que o PM diga já o que a Madeira deve esperar, quer para efeitos externos, quer para efeitos nacionais e regionais, quer por motivos políticos, quer por mera questão de decência, e este é (pode ser) o momento definidor do mandato de Passos Coelho.

- Contrariamente ao que se diz, Passos Coelho não necessita do PSD Madeira. Não necessita dos deputados Madeirenses agora, (se não estou enganado), e no futuro, não os terá porque o PSD Madeira afunda-se nos próximos quatro anos (mas, não nas eleições de Outubro). Mas se Passos Coelho falar claro e grosso - o que seria aquilo que, do ponto de vista ético, deveria sempre fazer - poderá dar um passo para ser reeleito nas próximas legislativas - os continentais, e não só, estão passados com Jardim.

- Convenhamos: não é Jardim que é o problema - ele é o que é. Existem muitos outros Jardins. O problema é o sistema democrático não se ter dotado das medidas de segurança em termos de governança que minimizassem as possibilidades de práticas como as cometidas pelo senhor. As leis para a maior parte das pessoas são restrições inactivas: se não as houvessem continuariam a ser e a comportarem-se de modo, civicamente, correcto. As leis e os regulamentos existem para minimizar os comportamentos desviantes que estão na margem, que são, sociologicamente, minoritários (pelo menos, em sociedades como a nossa).

- O PSD Açoriano teve uma típica reacção política pavloviana ao sugerir que pelos Açores haveriam problemas semelhantes. Não estão a perceber o filme em que estamos metidos. Ninguém que não não veja só para além do tradicional jogo partidário queria que houvesse, agora, buracos, e deste tipo de buracos, na Madeira. Logo ninguém quer mais buracos, mesmo que esses buracos sejam no quintal do vizinho mais odiado - porque vão sobrar para todos. O PSD Açoriano deveria ter referido que nos Açores, face à sua melhor informação, a situação não tem, nem de perto, nem de longe, semelhanças com a gravidade do que se passou na Madeira. A principal preocupação táctica do PSD Açoriano neste momento (e do nacional - de novo, o tal momento definidor) seria desmarcar-se de Jardim. Para mim isto é tão óbvio que acredito que mesmo na situação em que o PSD Açores, por mera hipótese de discussão, tivesse informação sólida em contrário, deveria proceder dessa forma, e a ter que falar de transparência agora, deveria fazê-lo relevando que o objectivo era haver uma total separação das águas entre as duas regiões autónomas na opinião pública, nacional e internacional - e só depois capitalizaria com as más notícias, havendo-as realmente. Para que conste, se houvesse problemas semelhantes nos Açores, eu teria a minha segunda grande surpresa na minha vida, e ambas da responsabilidade do PGRA.

- E o povo da Madeira irá ser sábio? Muito, provavelmente, não. A sabedoria dos povos depende da tradição, da prática, do conhecimento e dos incentivos, e nos tempos que correm - por todo o lado e não só na Madeira - todo o processo político anda pela rua da amargura: quem foi que disse que a política era a arte de convencer um povo a cumprir um destino? Mas quando falo de sabedoria popular falo da acepção estrita do conceito: qual é a solução eleitoral que aumenta a capacidade contratual dos madeirences na minimização dos sacrifícios que virão aí? Cheira-me que um governo que não tenha o Jardim, de preferência formado só pela oposição, terá uma muito maior capacidade contratual face ao Governo da República. Jardim transformou-se, por culpa sua, na bête noire do regime, e dar-lhe pancada, e por inerência nos madeirenses - veja-se a cautela dos comunistas - são dividendos políticos em caixa. Passos Coelho quer (ou deveria querer) a vitória de Jardim por outros motivos que não os de mera solidariedade de partido: a vitória de Jardim será o afundanço eleitoral do PSD Madeira nas outras eleições legislativas regionais que não as de Outubro próximo, mas se o PSD nacional perde a Madeira pode, no entretanto, ganhar o País daqui a 4 anos (vejam-se as últimas sondagens).

- O óbvio: a Lei das Finanças Regionais de Guterres foi o pináculo das boas venturanças que as Regiões Autónomas poderão almejar no domínio da solidariedade nacional.

- E quanto aos Açores? A crise e agora Jardim serão os bodes expiatórios do que aí vem em termos de impactos sobre as regiões autónomas. Defendi sempre que estava convencido que o PS ganharia na Região em 2012. Essa convicção foi abalada com a crise e com a possível saída de Carlos César. Agora, já não sei, mas inclino-me, neste altura, para o que sentia anteriormente. Talvez desenvolva, futuramente, a idéia - se tiver pachorra para o efeito.

EUA: recordando o cerne da questão ...

[....] Obama proposed new taxes on the wealthy — including a special new tax for millionaires, the closing of loopholes and deductions for people making more than $250,000 a year, and an end to the portion of the Bush tax cut going to higher incomes. Republicans accuse the President of instigating “class warfare.” But it’s not warfare to demand the rich pay their fair share of taxes to bring down America’s long-term debt.

After all, the richest 1 percent of Americans now takes home more than 20 percent of total income. That’s the highest share going to the top 1 percent in almost 90 years.And they now pay at the lowest tax rates in half a century — half the rate they paid on ordinary income prior to 1981.(Unfortunately, the President isn’t proposing to raise the capital-gains tax — which, now at 15 percent, creates a loophole large enough for the super-rich to drive their Ferrari’s through. About 80 percent of the income of America’s richest 400 comes in the form of capital gains. Here’s where billionaire hedge-fund and private-equity fund managers make out like bandits. As I’ve noted, I also wish he aimed higher — for more brackets and higher rates at the very top. But at least he’s drawn a line in the sand. The veto message is clear.)Anyone who says the American economy suffers when the rich pay more in taxes doesn’t know history. We grew faster the first three decades after World War II than we have since.Trickle-down economics has been a cruel joke. On the other hand — given projected budget deficits — if the rich don’t pay their fair share, the rest of us will have to bear more of a burden. And that burden inevitably will come in the form of either higher taxes or fewer public services.If anyone’s declared class warfare it’s the people who inhabit the top rungs of big corporations and Wall Street (and who comprise a disproportionate number of America’s super rich). They’ve declared it on average workers. The ratio of corporate profits to wages is higher than it’s been since before the Great Depression. And even as corporate salaries and perks keep rising, the median wage keeping dropping, and jobs continue to be shed.You’ve got the chairman of Merck taking home $17.9 million last year. This year Merck announces plans to boot 13,000 workers. The CEO of Bank of America takes in $10 million, and the bank announces it’s firing 30,000 workers.

Sobre a inovação na educação

O bold é meu:

Na semana passada, foi divulgado o estudo ‘Education at a Glance 2011’ da OCDE , em que se apresenta uma análise evolutiva dos sistemas educativos de 42 países ao longo das últimas décadas.A média dos países da OCDE avançou, nos últimos 30 anos, 15 p.p. na proporção de pessoas com formação superior. Portugal, por sua vez, progrediu 16 p.p., apesar de ainda permanecer com um dos valores absolutos mais baixos da OCDE. O melhor desempenho neste quesito foi o da Coreia do Sul, que neste mesmo período aumentou em 50 p.p. a proporção de pessoas com formação superior.Mas o que estes resultados não evidenciam é que a maioria dos modelos educativos em vigor, mesmo nos chamados países desenvolvidos, não tem acompanhado a rápida transformação do mundo moderno. Antes pelo contrário, até hoje a maioria dos sistemas educacionais tem-se concentrado na imposição de uniformidade curricular e de padrões desajustados das necessidades da nova Economia.

Astronomy Picture of the Day, 2011 September 20 - Planeta com dois sóis

Kepler-16b: A Planet with Two Suns

Illustrated Video Credit: NASA , JPL-Caltech, T. Pyle; Acknowledgement: djxatlanta

Illustrated Video Credit: NASA , JPL-Caltech, T. Pyle; Acknowledgement: djxatlanta

Explanation: If you stay up long enough, you can watch both suns set. Such might be a common adage from beings floating in the atmosphere of Kepler 16b, a planet recently discovered by the space-based Kepler satellite. The above animated video shows how the planetary system might look to a visiting spaceship. Although multiple star systems are quite common, this is the first known to have a planet. Because our Earth is in the orbital plane of both stars and the planet, each body is seen to eclipse the others at different times, producing noticeable drop offs in the amount of light seen. The frequent eclipses have given Kepler 16b the most accurate mass and radius determination for a planet outside our Solar System. To find a planet like Saturn in an orbit like Venus -- so close to its binary star parents -- was a surprise and will surely become a focus of research.

19 de setembro de 2011

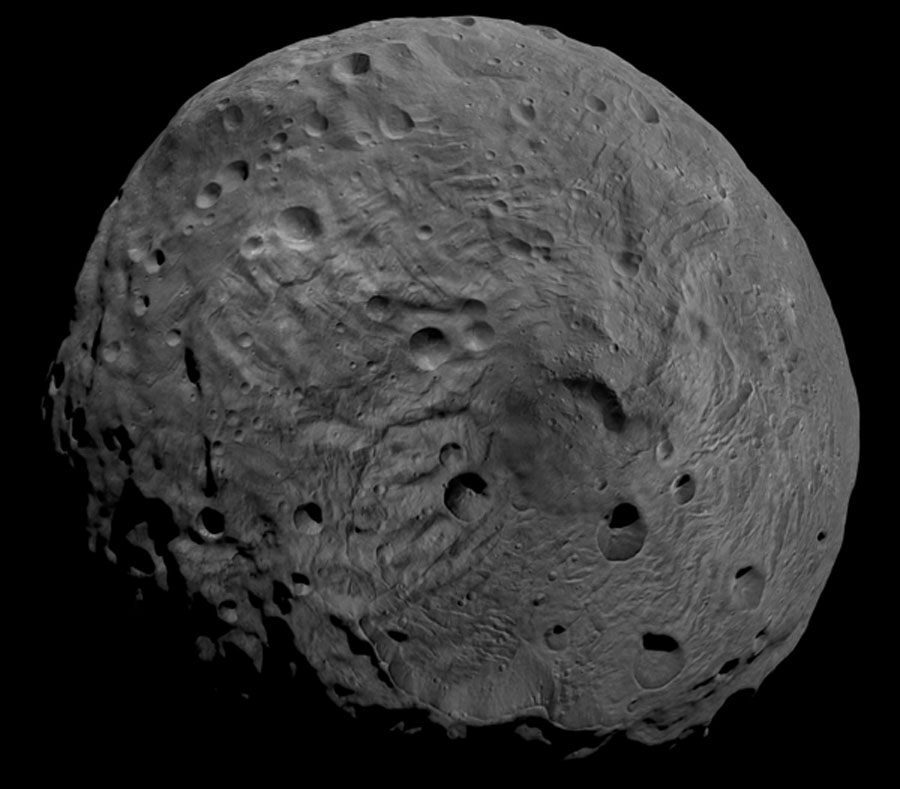

Astronomy Picture of the Day, 2011 September 19 - Polo Sul de Vesta

|

| The South Pole of Asteroid Vesta Image Credit: NASA, JPL-Caltech, UCLA, MPS, DLR, IDA |

Explanation: What created the circular structure around the south pole of asteroid Vesta? Pictured above, the bottom of the second largest object in the asteroid belt was recently imaged for the first time by the robotic Dawn satellite that arrived last month. A close inspection of the 260-meter resolution image shows not only hills and craters and cliffs and more craters, but ragged circular features that cover most of the lower right of the 500-kilometer sized object. Early speculation posits that the structure might have been created by a collision and coalescence with a smaller asteroid. Alternatively, the features might have originated in an internal process soon after the asteroid formed. New clues might come in the next few months as Dawn spirals down toward the rocky world and obtains images of increasingly high resolution.

18 de setembro de 2011

Muita gente referiu este artigo - embora não sempre o citando - e merece ser lido: é sobre o momento Euro

Deve ser lido na totalidade (o bold é meu):

A rescue must do four things fast. First, it must make clear which of Europe’s governments are deemed illiquid and which are insolvent, giving unlimited backing to the solvent governments but restructuring the debt of those that can never repay it. Second, it has to shore up Europe’s banks to ensure they can withstand a sovereign default. Third, it needs to shift the euro zone’s macroeconomic policy from its obsession with budget-cutting towards an agenda for growth. And finally, it must start the process of designing a new system to stop such a mess ever being created again. The fourth part will take a long time to complete: it will involve new treaties and approval by parliaments and voters. The others need to be decided on speedily (say over a weekend, when the markets are shut) with the clear aim that European governments and the European Central Bank (ECB) act together to end today’s vicious circle of panic, in which the weakness of government finances, the fragility of banks and worries about low growth all feed on each other.

Variações sobre o "soi-disant" economicismo

Deve-se ler o artigo na totalidade:

1. Economics is about ethicsUnderstood properly economics is an ethical science, an important branch of moral philosophy. For it concerns how to understand, manage and fulfil the heterogeneous and often conflicting values, interests, and capacities of large numbers of individuals operating within the constraints of limited resources. That system-level attention to the key aspects of heterogeneity, conflict, and scarcity should be a central concern of moral philosophy, but all too many moral philosophers are content to focus on the micro-level: identifying objects of intrinsic moral status e.g. friendship; or exploring particular kinds of relationships e.g. the nature of exploitation. Moral philosophy combines a high-minded concern for finding and testing the right abstract moral theory with an individualistic understanding of the phenomenology of morality as something akin to self-exploration and discovery. Society is surprisingly absent. This lacuna frequently leads moral philosophers to wish away or parenthesise (idealise) those aspects of heterogeneity, conflict and scarcity unavoidable in a moral community. Economists as social scientists have been thinking about this subject for a very long time, and have much of importance to say about it.For example, economists have addressed the centrality of scarcity by developing the concept of opportunity cost. Given scarce means you will not be able to do everything you want. For example, you may not be able to give $500 to the Somalia famine appeal and also take your long planned trip to visit your ailing grandmother. The cost of choosing one rather than the other is not the money. Money is not important: it merely represents your purchasing power constraints and only an idiot would try to acquire money for its own sake. Rather, the cost of choosing charity over filial piety is the full value (including the full ethical value) of the alternative you thereby give up. Moral philosophy rarely considers the full costs of actions in this broad sense and is the poorer for that.

17 de setembro de 2011

No entretanto, entre o Jardim e a extensão do gelo no Ártico, importa ir tendo atenção a isto ...

Global Food Prices Stuck Near Record High Levels | ThinkProgress

World food prices remained virtually unchanged between July and August 2011 according to the FAO Food Price Index published today.

The Index averaged 231 points last month compared to 232 points in July. It was 26 percent higher than in August 2010 but seven points below its all-time high of 238 points in February 2011.

In over two decades of tracking world food prices, the U.N. Food and

Agricultural organization index has never stayed so high for so high.

This represents true suffering for hundreds of millions of people who

live on the edge, for whom food is a large fraction of their income

like, say, North Africa (see Expert consensus grows on contribution of record high food prices to Middle East unrest).

And this year’s warming-driven extreme weather is likely to help keep food prices high for a while:

16 de setembro de 2011

Passos Coelho, enquanto lider do PSD - não, como é óbvio, enquanto PM - deveria efectivamente retirar a confiança política a Jardim invocando para o efeito, nomeadamente, ele ter-se vindo a constituir como o maior inimigo das autonomias regionais portuguesas ...

No entretanto, para uma visão de contexto (o bold é meu) :

There is little doubt that public debts have become outsized in many developed countries. Worse, they are expected to keep growing over the next decades as populations age. The financial markets have now set their eyes on this situation, making it difficult or expensive to borrow for a number of Eurozone countries, and the list could grow and expand beyond the Eurozone.

- Long ignored, the issue of public debt sustainability among developed countries has been brought to the forefront as a result of the crisis.

- The need to recapitalise banks and to provide fiscal stimuli to avoid another Great Depression has resulted in public debt increases of 20% to 30% of GDP.

The problem is that this increase comes on top of previously sizeable debts. For many countries, the challenge is to firmly establish fiscal discipline, an undertaking that has eluded them for decades. The 13th Geneva Report on the World Economy examines the case of the Eurozone, Japan, and the US.It’s all about institutions

To varying degrees, Japan, the US, and many Eurozone countries have let their public debts grow in good and bad times alike. The Geneva Report proposes a common interpretation of this widespread phenomenon and draws policy implications. The interpretation is the well-known common-pool effect, an externality between recipients of public expenditures and taxpayers. Since those who benefit from a given public policy do not bear the full burden of funding it, they tend to ask for more spending (or tax benefits) than they would if they did. The externality also concerns the revenue side. Voters would prefer to receive the benefits of public spending, but let others either in the current generation or future generations pay for those benefits. The result is excessive deficits.The phenomenon is a general feature of democracies, but its severity depends on national characteristics. Empirical work (eg Kontopoulos and Perotti 1999) shows that it is stronger the larger is the number of decision makers with access to the general tax fund. Ideological and ethnic divisions or ethno-linguistic and religious fractionalisation also aggravate the common-pool problem.Mitigating the deficit bias faces the same problem in reverse. Instead of benefits, pain must be distributed, but, again, citizens prefer that others bear the burden of the adjustment, even though they favour fiscal adjustment in principle. The general solution involves good governance and good fiscal institutions, designed to reign in the common-pool effect by enforcing the budget constraint on political actors. However, because political conditions differ from country to country, there is no one-size-fits-all magic bullet. Fiscal institutions that work in one country may well fail in another.

15 de setembro de 2011

Uma das melhores coisas que li sobre a Grande Recessão ou, se quiserem, a Pequena Depressão

[...] Whereas subprime loans provided the disease, securitization created the network of risk whereby the virus could infect a much larger system. Among large banks, securitization rendered global finance ever more dependent upon the vast pool of mortgage-backed capital. Because this capital was premised upon expectations about future mortgage values, securitization permitted lenders to think that bad risks could be leavened by bundling them with other mortgages, and then passed on to the balance sheets of other financial institutions. Lending standards based upon fiduciary duty and sober forecasts gave way to imperatives for high turnover and eroded standards, and few if any bothered to question the fundamentals of the boom. “With no one caring about the harm to borrowers, to society, or even to themselves,” Engel and McCoy write, “subprime lending and subprime securitization descended into a Hobbesian nightmare.”Where was government in all this? Regulators such as the Office of Thrift Supervision (OTS) and the Office of the Comptroller of the Currency (OCC) might, in theory, have restrained the animal spirits. Yet they were infected by the same combination of dependence on fees and efficient market assumptions that stupefied mortgage lenders and large banks. The OTS and OCC are funded by fees charged to the banks they regulate; the more banks under their umbrella, the larger their budget. The OTS in particular depended heavily upon fees from WaMu—the bank’s assessments accounted for about one in eight of the agency’s operating budget dollars. More generally, the Bush-era appointees to these agencies starkly limited the reach of regulations and discouraged robust monitoring of banks and lenders. [....]

13 de setembro de 2011

China versus Índia: o que explica as diferenças nas taxas de crescimento?

Economist Yasheng Huang compares China to India, and asks how China's authoritarian rule contributed to its astonishing economic growth -- leading to a big question: Is democracy actually holding India back? Huang's answer may surprise you.

Enfim, anomalias em catadupa ...

The disinformers like to say the extreme weather we are seeing today is nothing unusual. They don’t live in Texas, where “No One on the Face of This Earth has Ever Fought Fires in These Extreme Conditions.” Or my hometown area around the Catskill Mountains, where Hurricane Irene was “the most devastating weather event ever to hit the region.” Or around Binghamton, NY, where “An Extreme Rainfall Event Unprecedented in Recorded History Has Hit.”

Para além das coisas que tem piada ("a sort of") há diversos pontos que cruzam com a nossa experiência ... faça a sua leitura, e julgue por si! ...

September has been Italy’s most uncertain month, with questions about whether the Parliament will pass an austerity package, if that package will be stringent enough and how Europe’s fiscal stewards will react. There’s also this: what sort of celebration will the country’s epically libidinous emperor — sorry, prime minister — orchestrate for his 75th birthday? Silvio Berlusconi’s big milestone is about two weeks away, and you have to assume he’ll pull out all the stops, but you also have to wonder what stops are left to be pulled. The man hasn’t been shy about sating himself.As we now know, thanks to his current trial on charges of paying for sex with a minor, he regularly assembles veritable harems of young women for bacchanals with a dress code that could be described as whimsical. He calls them “bunga bunga” parties, which has no particular translation and no need of one. The hormonal gist comes through.The bunga allegations grabbing headlines last week were that Berlusconi, in moments of pulchritudinous piety, was treated to lap dances from women attired as nuns. This followed claims that he received ministrations from women outfitted as nurses. And it’s said that Italy is a chauvinistic society! For Berlusconi, no profession is beyond a woman’s pantomime.

We Americans have found great entertainment in all of this — lengthy Berlusconi exposés appeared recently in The New Yorker and Vanity Fair — because it’s lurid, yes, but also because it’s reassuring. Our own political madness pales beside his triple-X opera buffa.But we shouldn’t just gape and laugh. His country’s path from glorious to ridiculous, paved in part by his carnal and legal distractions, threatens the financial stability of Europe, and benefits no one. Beyond that, Italy presents a cautionary tale for many immodestly privileged Western democracies that have been lulled by comfort into complacency; have let too much silliness create too much damage; and haven’t held leaders to adequate account.

11 de setembro de 2011

Enfim, confirma-se ....

AFP: The area covered by Arctic sea ice reached its lowest point this week since the start of satellite observations in 1972, German researchers announced on Saturday…. “This is a new historic minimum,” said Georg Heygster, head of the Physical Analysis of Remote Sensing Images unit at the University of Bremen….

9 de setembro de 2011

A eminência do colapso do projecto europeu

BERKELEY – Europe is again on the precipice. The most recent Greek rescue, put in place barely six weeks ago, is on the brink of collapse. The crisis of confidence has infected the eurozone’s big countries. The euro’s survival and, indeed, that of the European Union hang in the balance.

European leaders have responded with a cacophony of proposals for restoring confidence. Jean-Claude Trichet, the president of the European Central Bank, has called for stricter budgetary rules. Mario Draghi, head of the Bank of Italy and Trichet’s anointed successor at the ECB, has called for binding limits not on just budgets but also on a host of other national economic policies. Guy Verhofstadt, leader of the Alliance of Liberals and Democrats for Europe in the European Parliament, is only one in a growing chorus of voices calling for the creation of Eurobonds. Germany’s finance minister, Wolfgang Schäuble, has suggested that Europe needs to move to full fiscal union.

If these proposals have one thing in common, it is that they all fail to address the eurozone’s immediate problems. Some, like stronger fiscal rules and closer surveillance of policies affecting competitiveness, might help to head off some future crisis, but they will do nothing to resolve this one. Other ideas, like moving to fiscal union, would require a fundamental revision of the EU’s founding treaties. And issuing Eurobonds would require a degree of political consensus that will take months, if not years, to construct.

But Europe doesn’t have months, much less years, to resolve its crisis. At this point, it has only days to avert the worst. It is critical that leaders distinguish what must be done now from what can be left for later.

The first urgent task is for Europe to bulletproof its banks. Doubts about their stability are at the center of the storm. It is no coincidence that bank stocks were hit hardest in the recent financial crash. There are several ways to recapitalize Europe’s weak banks. The French and German governments, which have budgetary room for maneuver, can do so on their own. In the case of countries with poor fiscal positions, Europe’s rescue fund, the European Financial Stability Facility, can lend for this purpose. If still more money is required, the International Monetary Fund can create a special facility, using its own resources and matching funds put up by Asian governments and sovereign wealth funds.

Para variar, Krugman elogia Obama

Setting Their Hair on Fire, by Paul Krugman, Commentary, NY Times: First things first: I was favorably surprised by the new Obama jobs plan, which is significantly bolder and better than I expected. It’s not nearly as bold as the plan I’d want in an ideal world. But if it actually became law, it would probably make a significant dent in unemployment. ...

Continuar a ler em Economist's View: Paul Krugman: Setting Their Hair on Fire

Já estamos para além da anomalia, convenhamos ...

“Well, it’s not really good timing to write about global warming when the summer feels cold and rainy”, a journalist told me last week. Hence, at least here in Germany, there hasn’t been much reporting about the recent evolution of Arctic sea ice – despite the fact that Arctic sea ice extent in July, for example, was the lowest ever recorded for that month throughout the entire satellite record. Sea-ice extent in August was also extremely low, second only to August 2007 (Fig. 1). Whether or not we’re in for a new September record, the next weeks will show.

Figure 1: Evolution of Arctic sea-ice extent in July and August from 1979 until 2011. (NSIDC)A rainy summer might be one reason for an apparent lack of public attention with respect to the ongoing sea-ice loss. Another reason, however, is possibly the fact that we scientists have failed to make sufficiently clear that a major loss of sea ice during the early summer months is climatologically more important than a record minimum in September. This importance of sea-ice evolution during the early summer months is directly related to the role of sea ice as an efficient cooling machine: Because of its high albedo (reflectivity), sea ice reflects most of the incoming sunlight and helps to keep the Arctic cold throughout summer. The relative importance of this cooling is largest when days are long and the input of solar radiation is at its maximum, which happens at the beginning of summer. If, like this year, sea-ice extent becomes very low already at that time, solar radiation is efficiently absorbed throughout all summer by the unusually large areas of open water within the Arctic Ocean. Hence, rather than being reflected by the sea ice that used to cover these areas, the solar radiation warms the ocean there and thus provides a heat source that can efficiently melt the remaining sea ice from below. In turn, additional areas of open water are formed that lead to even more absorption of solar radiation. This feedback loop, which is often referred to as the ice-albedo feedback, also delays the formation of new sea ice in autumn because of the accompanying surplus in oceanic heat storage.Measurements from ice buoys show that indeed melting at the bottom of the sea ice has increased significantly in recent years. While field experiments that were carried out in the 20th century showed unambiguously that surface melting used to be the dominant mechanism for the thinning of Arctic sea ice, now in larger and larger areas melting at the underside of the ice is almost equally important. Such melting from below is particularly efficient since the temperature at the ice-ocean interface is fixed by the phase equilibrium that must be maintained there. Hence, any heat provided by the ocean to this interface will lead to thinning of the ice in summer and to slower ice growth in winter. At the surface, the ice temperature is not fixed as long as the ice isn’t melting, and heat input from the atmosphere can in part be compensated for by a change in surface temperature and an accompanying change in outgoing long-wave radiation at the ice surface.

Continua ...

8 de setembro de 2011

Gasolina com e sem chumbo; tabaco; CO2 ...

As duas primeiras notas historiam como apareceu a gasolina com chumbo, como lidaram com ela e as suas consequências. O interesse óbvio da história é que rima [citando Mark Twain, de memória: a história não se repete, mas rima muitas vezes] com outras histórias acontecidas, também nos EUA, como a do tabaco, a dos medicamentos, a dos alimentos, e claro, com a história em curso relativa ao CO2. Os processos são sempre os mesmos: desacreditar a boa ciência com a ciência marcenária, imputando a existência de controvérsia onde ela é tão somente fabricada; comprar o poder político e por aí adiante.

A última história é sobre a indústria tabaqueira chinesa e lembra-nos que as coisas acontecem, também, em outros lados.

At the Door of the Loony Gas Building | Speakeasy Science

Of Dead Bodies and Dirty Streets | Speakeasy Science

Scenes from the tobacco harvest: Why China can't quit smoking | Danwei

Consequências de uma eventual saída do euro

Desintegração da zona euro poderia gerar ditaduras e guerras civis. São as conclusões políticas de um estudo de choque da equipa de investigação do banco suíço UBS. O estudo quantifica a secessão de um “periférico” e a saída de um dos países do núcleo duro da zona monetária. Em qualquer dos casos, as consequências são pesadas.

Conviria que lessem a nota na totalidade ...

6 de setembro de 2011

Ninguém está a ouvir ...

I cannot be the only person who fears that the situation we are in is causing Martin Wolf's mind to crack. I hope the Financial Times has psychiatrists standing by:

Martin Wolf: We must listen to what bond markets are telling us: What is to be done? To find an answer, listen to the markets. They are saying: borrow and spend, please. Yet those who profess faith in the magic of the markets are most determined to ignore the cry. The fiscal skies are falling, they insist.HSBC forecasts that the economies of high-income countries will now grow by 1.3 per cent this year and 1.6 per cent in 2012. Bond markets are at least as pessimistic: US 10-year Treasuries yielded 1.98 per cent on Monday, their lowest for 60 years; German Bunds yielded 1.85 per cent; even the UK could borrow at 2.5 per cent. These yields are falling fast towards Japanese levels. Incredibly yields on index-linked bonds were close to zero in the US, 0.12 per cent in Germany and 0.27 per cent in the UK.

Are the markets mad? Yes, insist the wise folk: the biggest risk is not slump, as markets fear, but default. Yet if markets get the prices of such governments’ bonds so wrong, why should one ever take them seriously? The massive fiscal deficits of today, particularly in countries where huge financial crises occurred, are not the result of deliberate Keynesian stimulus: even in the US, the ill-targeted and inadequate stimulus amounted to less than 6 per cent of gross domestic product or, at most, a fifth of the actual deficits over three years. The latter were largely the result of the crisis: governments let fiscal deficits rise, as the private sector savagely retrenched.To have prevented this would have caused a catastrophe. As Richard Koo of Nomura Research has argued, fiscal deficits help the private sector deleverage. That is precisely what is happening in the US and UK (see chart at bottom). In the US, the household sector moved into financial surplus after house prices started to fall, while the business sector moved into surplus in the crisis. Foreigners are persistent suppliers of capital. This has left the government as borrower of last resort. The UK picture is not so different, except that the business sector has been in persistent surplus.

Anomalias

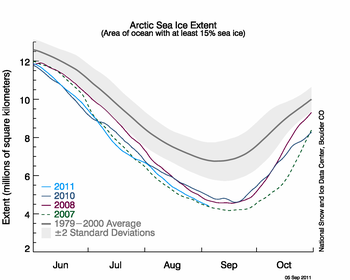

Overview of conditions

Average ice extent for August 2011 was 5.52 million square kilometers (2.13 million square miles). This is 160,000 square kilometers (61,800 square miles) above the previous record low for the month, set in August 2007, and 2.15 million square kilometers (830,000 square miles), or 28% below the average for 1979 to 2000. Sea ice coverage remained below normal everywhere except the East Greenland Sea. In addition, several large areas of open water (polynyas) have opened within the ice pack.

Average ice extent for August 2011 was 5.52 million square kilometers (2.13 million square miles). This is 160,000 square kilometers (61,800 square miles) above the previous record low for the month, set in August 2007, and 2.15 million square kilometers (830,000 square miles), or 28% below the average for 1979 to 2000. Sea ice coverage remained below normal everywhere except the East Greenland Sea. In addition, several large areas of open water (polynyas) have opened within the ice pack.

On August 31, 2011 Arctic sea ice extent was 4.63

million square kilometers (1.79 million square miles). This is 100,000

square kilometers (38,600 square miles) higher than the previous record

low for the same day of the year, set in 2007. As of September 5, ice

extent had fallen below the minimum ice extents in September 2010 and

2008 (previously the third- and second-lowest minima in the satellite

record). If ice stopped declining in extent today it would be the

second-lowest minimum extent in the satellite record.

|

|

Figure 2. The graph above shows daily Arctic sea ice extent as of

September 2, 2011, along with daily ice extents for previous

low-ice-extent years. Light blue indicates 2011, dashed green shows

2007, dark blue shows 2010, purple shows 2008, and dark gray shows the

1979 to 2000 average. The gray area around the average line shows the

two standard deviation range of the data. Sea Ice Index data. —Credit: National Snow and Ice Data Center |

No que Marx, efectivamente, acertou ...

Karl Marx may have been wrong about communism but he was right about much of capitalism, John Gray writes.As a side-effect of the financial crisis, more and more people are starting to think Karl Marx was right. The great 19th Century German philosopher, economist and revolutionary believed that capitalism was radically unstable.It had a built-in tendency to produce ever larger booms and busts, and over the longer term it was bound to destroy itself.Marx welcomed capitalism's self-destruction. He was confident that a popular revolution would occur and bring a communist system into being that would be more productive and far more humane.Marx was wrong about communism. Where he was prophetically right was in his grasp of the revolution of capitalism. It's not just capitalism's endemic instability that he understood, though in this regard he was far more perceptive than most economists in his day and ours.Marx co-authored The Communist Manifesto with Friedrich Engels

Mas o inefável Ministro das Finanças da Alemanha, e elemento destacado do "pain caucus", discorda do Krugman, do Wolf, do Wolfgang Münchau... e, no fim do dia, veremos quem tem razão.

Nas últimas semanas, os mercados obrigacionistas têm registado variações alucinantes, levando alguns analistas e comentadores a questionar os progressos alcançados para controlar a crise da dívida soberana na zona euro.Mais recentemente, surgiram dados e indicadores económicos que muitos economistas consideram apontar para uma retoma global titubeante.

Ao invés de clarificar posições, estes desenvolvimentos suscitaram uma cacofonia de receitas sobre o que devem os governos ocidentais fazer a seguir. Houve pedidos para que os reguladores contivessem os especuladores, para que os bancos centrais afrouxassem ainda mais a política monetária, para que os EUA e Alemanha utilizassem o seu suposto "espaço orçamental" para fomentar a procura e para que os líderes da União Europeia enveredassem imediatamente para uma união orçamental e dívida conjunta. Está na hora, mais do que nunca, de clarificar mensagens e prioridades.

Independentemente do papel desempenhado pelos mercados na catalisação da crise da dívida soberana na zona euro, é um facto incontornável que o excesso de despesa estatal gerou níveis de endividamento insustentáveis e défices. Aumentar agora o endividamento vai pôr em perigo o crescimento a longo prazo. Os governos não devem apenas comprometer-se com a consolidação orçamental e o aumento da competitividade - devem avançar imediatamente nesse caminho.

Pois é: deveria ser feito assim, embora não perceba aquilo de todos abandonarem os programas de austeridade: não poderia ser atenuar ou dilatar no tempo esse esforço?

FT: O pior da crise do euro ainda está para vir | Económico| Wolfgang Münchau

Um dos aspectos actualmente mais preocupantes na zona euro é o facto de qualquer estratégia de resolução da crise estar directamente dependente de uma recuperação económica moderadamente forte.

O programa grego estava em apuros quando foi acordado há seis semanas. Todas as previsões oficiais estavam erradas. O país está numa depressão, e a dinâmica da sua dívida está "fora de controlo", afirma o seu novo conselho fiscal. Em Itália, o banco central está preocupado com a eventualidade do programa de austeridade poder vir a ter efeitos recessionistas.

A estratégia de recapitalização - se assim lhe quisermos chamar - está também a cair por terra sob o peso do abrandamento económico. Na semana passada, assistimos a uma acesa disputa entre o FMI e os governos da zona euro quanto ao montante necessário para a recapitalização. Os dados finais relativamente à recapitalização podem ser muito mais elevados do que as estimativas do FMI se a economia voltar a entrar em recessão.

5 de setembro de 2011

Isto tem a ver com a economia portuguesa, e de que maneira, mas não da forma que alguns pensarão ...

Sim, a economia portuguesa está carente de procura, mas da procura externa da sua produção, e os juros da dívida portuguesa não estão a zero!

Thughts on Paul Krugman on Macroeconomic Policy

Thughts on Paul Krugman on Macroeconomic Policy

Paul Krugman:

I would add another page to the book. What in most important is not just what Obama proposes on Thursday (because nothing will get done by congress), but rather what he does in the weeks and months afterwards to actually tune the economy so that it creates more jobs. I think Obama should:

The Fatal Distraction: Multiple surveys have shown that lack of demand — a lack that is being exacerbated by government cutbacks — is the overwhelming problem businesses face, with regulation and taxes barely even in the picture…. [W]hen McClatchy Newspapers recently canvassed a random selection of small-business owners to find out what was hurting them, not a single one complained about regulation of his or her industry, and few complained much about taxes. And did I mention that profits after taxes, as a share of national income, are at record levels?

So short-run deficits aren’t a problem; lack of demand is, and spending cuts are making things much worse. Maybe it’s time to change course? Which brings me to President Obama’s planned speech on the economy.

I find it useful to think in terms of three questions: What should we be doing to create jobs? What will Republicans in Congress agree to? And given that political reality, what should the president propose?… [W]e should have a lot of job-creating spending on the part of the federal government, largely in the form of much-needed spending to repair and upgrade the nation’s infrastructure. Oh, and we need more aid to state and local governments, so that they can stop laying off schoolteachers. But what will Republicans agree to? That’s easy: nothing…. This reality makes the third question — what the president should propose — hard to answer, since nothing he proposes will actually happen anytime soon. So I’m personally prepared to cut Mr. Obama a lot of slack on the specifics of his proposal, as long as it’s big and bold. For what he mostly needs to do now is to change the conversation…

I would add another page to the book. What in most important is not just what Obama proposes on Thursday (because nothing will get done by congress), but rather what he does in the weeks and months afterwards to actually tune the economy so that it creates more jobs. I think Obama should:

- Apply a full-court press to the Federal Reserve to get it to target nominal GDP to close the spending gap, for it is fear of risk that nobody will spend to buy what you make and confidence that your purchasing power is safe in cash that is holding back businesses from spending money to hire people.

- Apply a full-court press to the Federal Reserve to get it to engage in more quantitative easing--into taking more risk onto its own balance sheet, for it is an unwillingness on the part of Wall Street to hold the risk currently out there that is making it very difficult for a wide range of risky spending projects to get financing.

- Quantitative easing does not have to be done by the Fed: the Treasury can use residual TARP authority to take tail risk onto its own books as well, and should be doing so as much as possible.

- Expansion does not require that the federal government spend: using Treasury (and Fed!) money to grease the financing of infrastructure and other investments by states would pay enormous dividends.

- For the Treasury Secretary to announce that a weak dollar is in America's interest right now would not only boost exports, but it would immediately lead to a shift in monetary policy in Europe toward a much more expansionary profile--which would be good for the world.

No entretanto, se tivesse sido diferente...

Ler a nota referenciada na totalidade:

I'VE been meaning to draw attention to this analysis from Stuart Staniford (brought to my attention by Kevin Drum). In it, Mr Staniford asks what the world might have looked like had oil demand continued to grow from 2009 on at its 2000-2008 rate of increase:

In the counterfactual world, 2009 gross world product would have been 6.4 percent larger than in the actual world. We can estimate the implications for oil supply because we know that the global income elasticity of oil demand is about 2/3. Thus the counterfactual world would have required an additional 4.5 percent more oil than the real world.

…2009 oil production was around 85 [million barrels per day] (depending on what source you like) so in the counterfactual world we would have needed it to be around 88-89mbd. Now, in 2008, oil production got up to around 86mbd (on an average basis) but doing so triggered (or required) an oil shock in which prices briefly reached $135/barrel on a monthly basis and almost $150 on a daily basis. What would the likely price path have been had the world then needed an additional 2-3mbd the following year?

To give an indication of the scale of 2-3mbd, note that the loss of 1.6mbd of oil this year (Libya) triggered something like a $30 increase in the price of oil (before it became clear that the global economy was slowing again causing prices to fall). That, along with other commodity price increases, was enough to cause a little bump in inflation that significantly reduced the Federal Reserve's latitude for action. [....]

4 de setembro de 2011

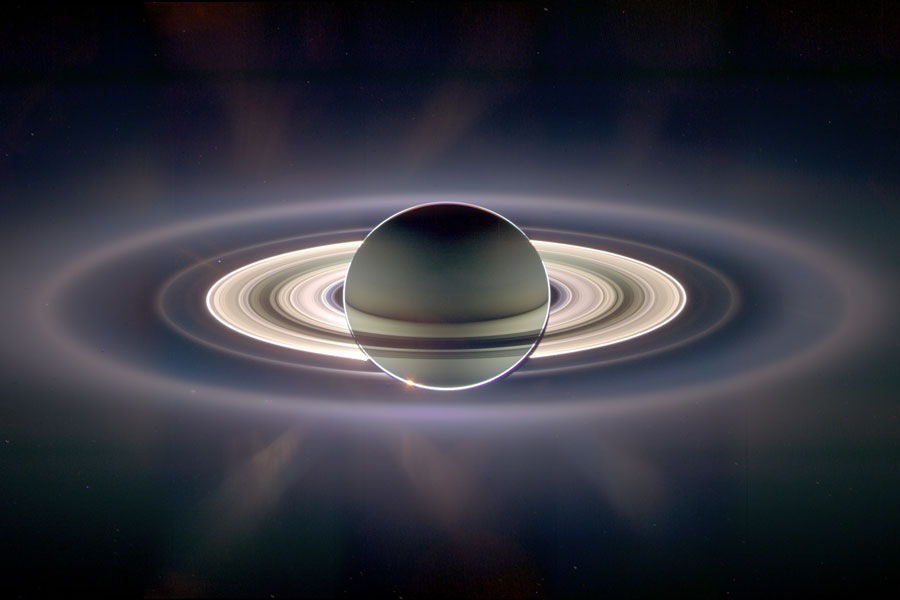

Astronomy Picture of the Day, 2011 September 4 - Na sombra de Saturno

|

| In the Shadow of Saturn Image Credit: Cassini Imaging Team , SSI, JPL, ESA, NASA |

Explanation: In the shadow of Saturn, unexpected wonders appear. The robotic Cassini spacecraft now orbiting Saturn drifted in giant planet's shadow for about 12 hours in 2006 and looked back toward the eclipsed Sun. Cassini saw a view unlike any other. First, the night side of Saturn is seen to be partly lit by light reflected from its own majestic ring system. Next, the rings themselves appear dark when silhouetted against Saturn, but quite bright when viewed away from Saturn, slightly scattering sunlight, in this exaggerated color image. Saturn's rings light up so much that new rings were discovered, although they are hard to see in the image. Seen in spectacular detail, however, is Saturn's E ring, the ring created by the newly discovered ice-fountains of the moon Enceladus and the outermost ring visible above. Far in the distance, at the left, just above the bright main rings, is the almost ignorable pale blue dot of Earth.

3 de setembro de 2011

O que me mete medo, realmente, ....

To make austerity in some European countries workable, you really needed stronger European economies not to be practicing austerity; austerity for all was and is a recipe for failure.Truly, this is turning into a global disaster. Meanwhile, in Europe - NYTimes.com

O que me mete medo, realmente, pelo país, não é a dimensão dos sacrifícios, mas a possibilidade de eles serem em vão. Casos de sucesso - leia-se: traduzidos em crescimento económico - de estratégias nacionais de restrição orçamental sucederam (Irlanda,Suécia, por volta das décadas de 80 e 90) em contextos onde a procura externa ajudou de modo significativo.

Subscrever:

Comentários (Atom)